Kanye Crypto: From Fashion Icon to Blockchain Experiment

When Trends Meet Blockchain

Kanye West has long been a cultural and fashion icon, and now his brand influence is making waves in the crypto industry. With the rollout of the Kanye Crypto ecosystem, Yeezy is evolving from a symbol of shoes and style into a blockchain-powered global payments and digital asset solution.

At the core of this vision is Yeezy Money (YZY), supported by the Ye Pay payments platform and the YZY Card. The project is designed to blend the fan economy with crypto finance: users can pay for Yeezy products directly with YZY tokens and even use them for daily purchases worldwide, challenging the traditional boundaries of payment systems.

Financial Infrastructure: Hopes vs. Reality

Supporters highlight Kanye Crypto’s promise to create decentralized payment scenarios for brand-driven economies. Pain points like hefty international transaction fees and payment delays could be resolved with low-cost transfers, cross-border settlements, and anti-sniping mechanisms. The platform features transparent token unlock schedules, claiming these measures can prevent price crashes from sudden sell-offs and offer market stability. Yet, a gap persists between ambition and reality: on-chain data shows that initial YZY distribution is highly concentrated—94% of tokens are held in a handful of internal wallets—casting doubt on whether true decentralization is at play or just a marketing slogan.

Insiders and Speculation: A Closer Look

Despite Kanye Crypto’s pitch of payment innovation, much of the market buzz revolves around speculation and possible insider trading. Multiple blockchain analytics firms discovered that wallets linked to the Libra project were able to front-run the YZY listing, netting over $23 million in profits. Hours before the token’s public debut, $57 million associated with a Libra founder was suddenly unfrozen—timing that raised eyebrows and fueled speculation. In one case, a trader entered the market just 9 seconds before the public had access, growing their position to $1.8 million in only 8 minutes. These orchestrated moves have heightened suspicions of insider-controlled markets.

The Risks of Highly Centralized Control

While YZY’s token allocation appears divided across investors, team, ecosystem, and public tranches, in reality, most tokens are concentrated in a few addresses. Regardless of future payment or utility applications, the token’s price can still be swayed by a select group. Given this landscape, whether YZY can genuinely achieve its ambition as a payment currency remains highly uncertain.

Lessons from Kanye Crypto

Kanye Crypto illustrates how a trendsetting brand might attempt to financialize through blockchain, but it also exposes a core tension: celebrity power can quickly attract attention, but without transparency and decentralized governance, these projects risk being reduced to mere vehicles for speculation. For its backers, it represents an experiment in brand-driven Web3 finance; for doubters, it looks like just another crypto game with a celebrity veneer.

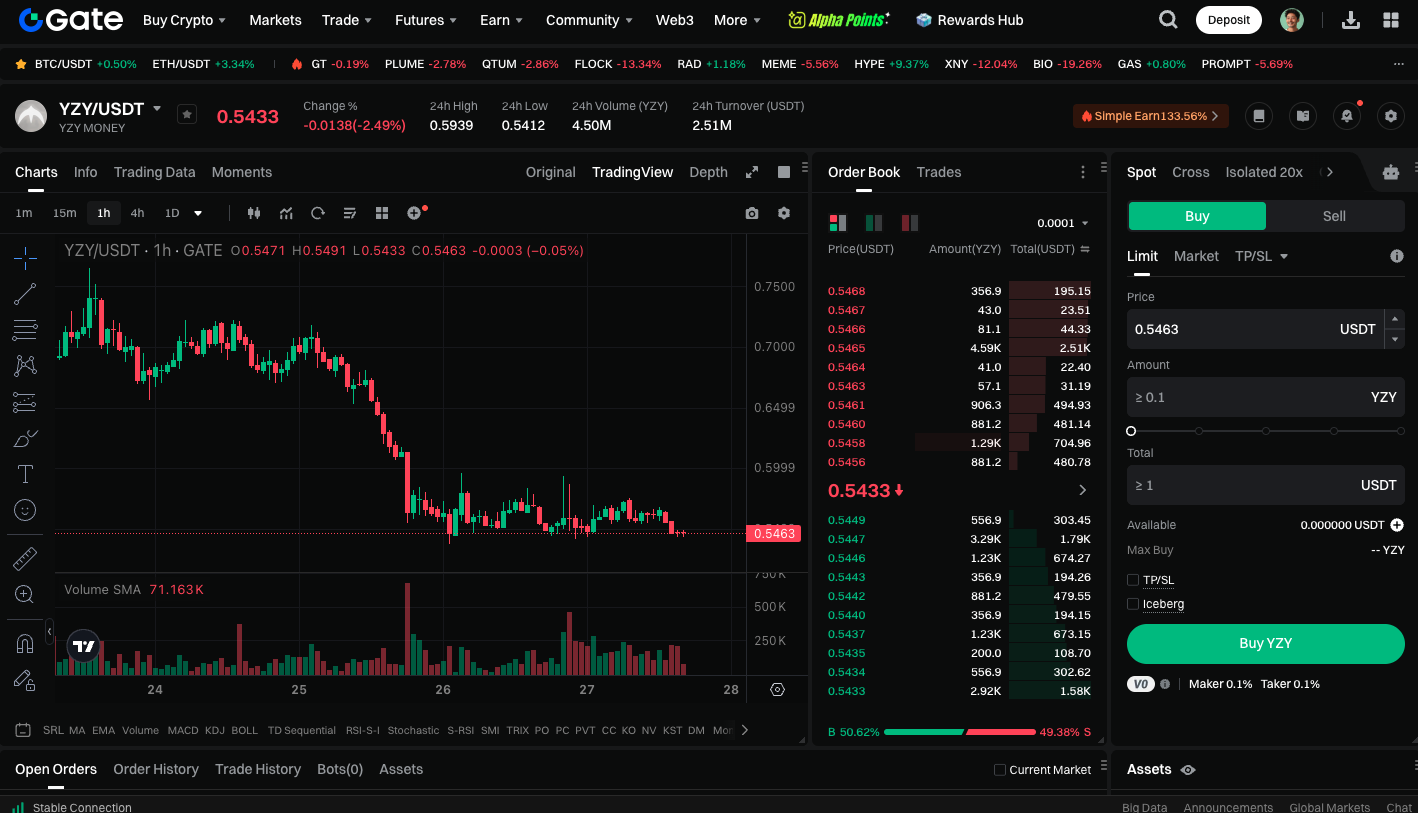

Start trading YZY spot now: https://www.gate.com/trade/YZY_USDT

Summary

The Kanye Crypto story is only just beginning, but it already leaves a dramatic mark on both the crypto market and cultural landscape. It’s an exploration of payments innovation—and a case study in trust and distribution disputes. For investors, the takeaway is clear: celebrity buzz generates excitement, but it can never replace the foundational values of decentralization.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025