CFTC Launches New Phase of Crypto Sprint, Opening Compliance Channels for Real-Time Trading of Digital Assets

Backed by strong support from the Trump administration, the United States is rapidly integrating crypto assets into the mainstream financial system. On August 1, the Commodity Futures Trading Commission (CFTC) officially launched its “Crypto Sprint” regulatory initiative. On August 5, the CFTC proposed bringing spot crypto assets onto Commodity Futures Trading Commission (CFTC)-registered designated contract markets (DCMs) for compliant trading. This was soon followed, on August 21, by the launch of the next phase of “Crypto Sprint,” prioritizing real-time trading of digital assets at the federal level. The primary focus is on addressing issues surrounding leveraged, margin, or financed retail trading by stakeholders on CFTC-registered exchanges. This initiative not only ends the long-standing regulatory ambiguity of the spot market, but also signals the emergence of a defined and actionable compliance pathway for the Web3 industry.

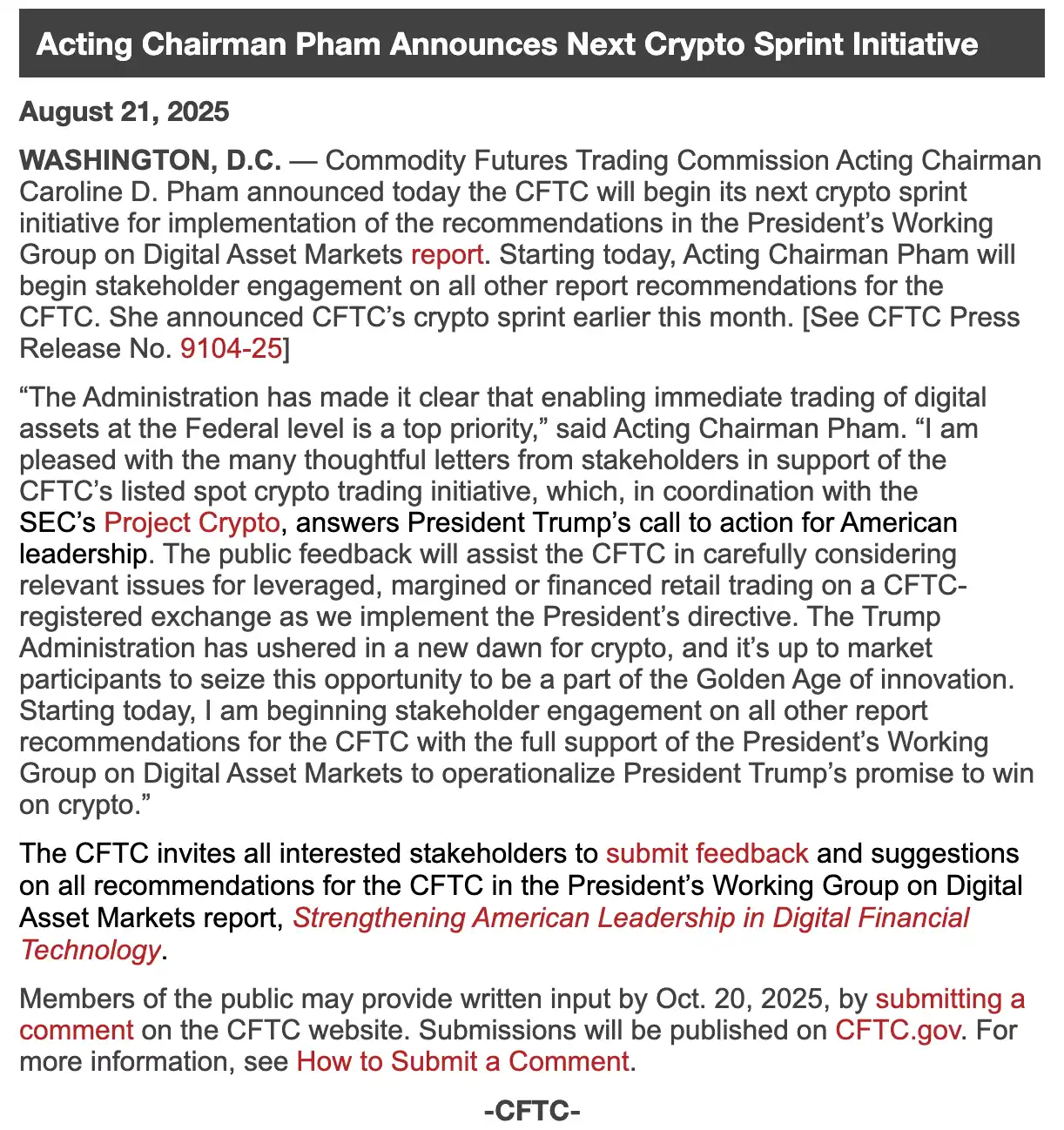

CFTC Acting Chair Caroline Pham publicly stated, “Under President Trump’s strong leadership, the CFTC is driving the advancement of federal-level spot trading for digital assets and is working in coordination with the SEC’s ‘Crypto Project.’” This statement sends a clear signal: US regulators are shifting from a “defensive crackdown” to “institutional acceptance,” opening unprecedented compliance opportunities for Web3 infrastructure, including DeFi, stablecoins, and on-chain derivatives.

Legalizing Spot Contracts: The Starting Point for the Institutionalization of Crypto Markets

For years, the US regulatory framework has lacked unified oversight of crypto spot trading. Trades involving assets like BTC and ETH have largely occurred on overseas platforms or unlicensed domestic exchanges. This lack of oversight has made investor protection difficult and kept substantial institutional capital on the sidelines.

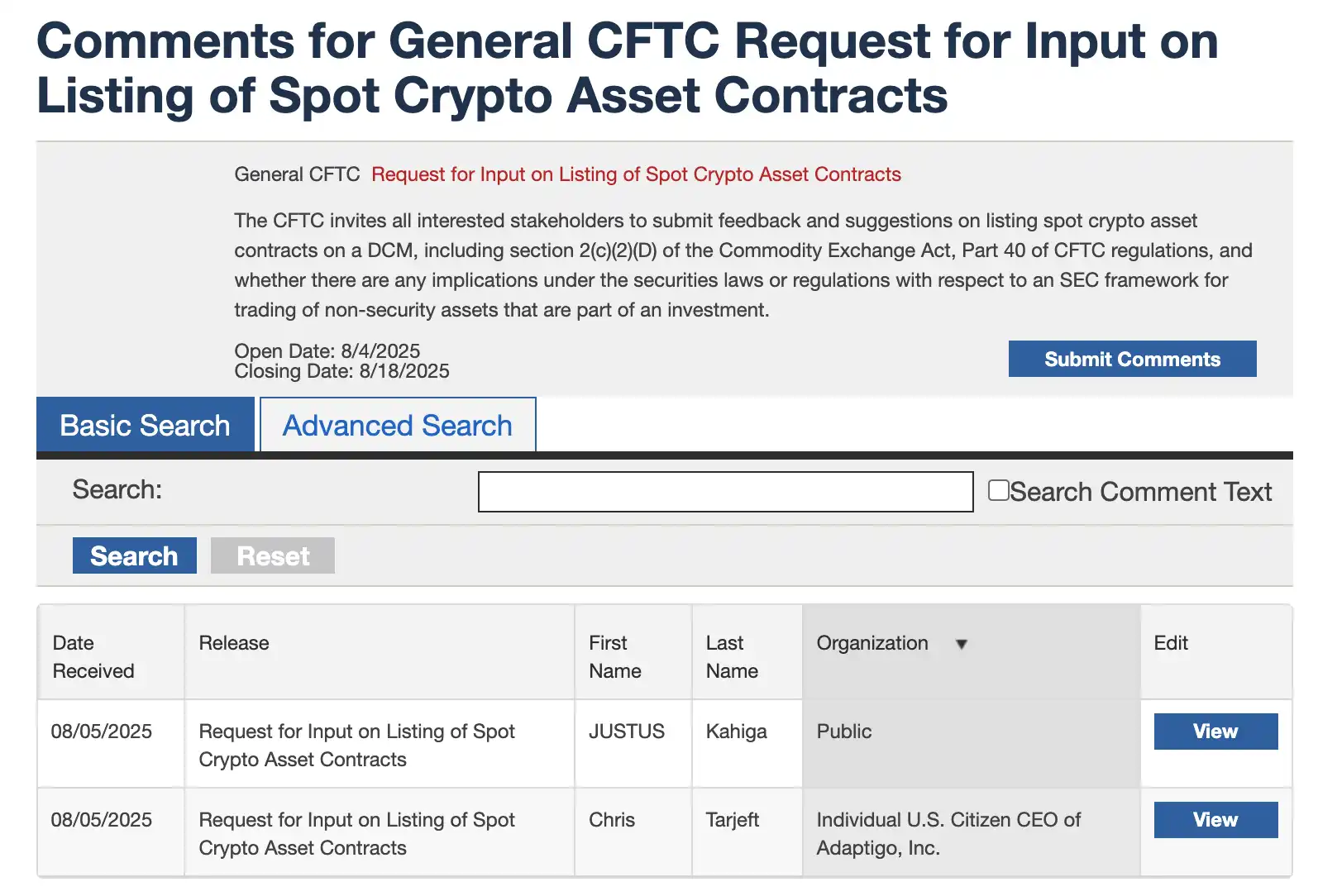

The CFTC’s “Crypto Sprint” directly targets this issue. One of its core components is to enable the legal listing of non-security crypto spot contracts on CFTC-registered DCMs. By authorizing these platforms to facilitate spot crypto trading, the CFTC is providing a compliant alternative to unlicensed or offshore exchanges—a market segment that, following the FTX collapse (2021) and ongoing regulatory challenges facing Binance, has steadily lost institutional credibility. For institutional investors, this policy offers a more legitimate, transparent, and equitable entry point to crypto assets, eliminating major obstacles to large-scale digital asset allocation.

According to the CFTC, Section 2(c)(2)(D) of the Commodity Exchange Act mandates that any commodity transaction involving leverage, margin, or financing must take place on a registered DCM. This provides robust legal grounding for the compliant listing of crypto spot contracts and brings much-needed regulatory clarity to the market. Under this framework, we may see centralized trading venues similar to Coinbase, or on-chain derivatives protocols like dYdX, obtain regulatory approval through DCM registration.

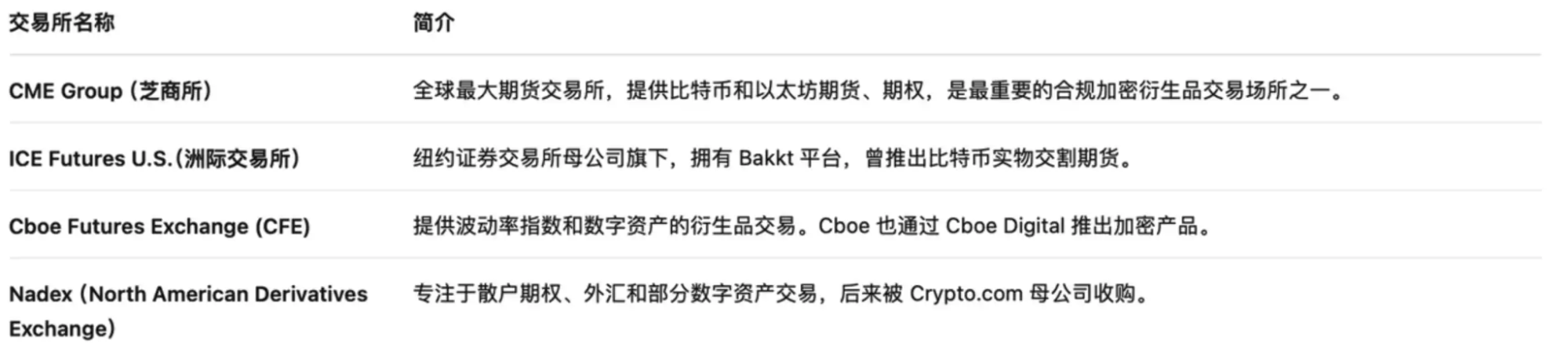

This policy also paves the way for traditional financial institutions to access crypto assets compliantly. The Chicago Mercantile Exchange (CME), as a leading DCM, already has mature BTC and ETH futures infrastructure. Once spot contracts receive regulatory approval, institutional investors will have a seamless gateway from futures to spot trading of digital assets, accelerating the pace of traditional capital entering the crypto space.

The new phase of “Crypto Sprint,” launched on August 21, aims to close regulatory gaps in market structure, custody solutions, stablecoin oversight, and anti-money laundering standards for digital assets. Andrew Rossow, CEO of AR Media Consulting, told Decrypt that the CFTC is seeking to establish a unified federal spot market for crypto assets to resolve longstanding interstate fragmentation and regulatory gray areas. He described these actions as part of a “federal legitimacy strategy” designed to drive foundational reform. Once federal restrictions are lifted, retail investors can expect stronger protections and a restoration of trust, helping to repair the market damage caused by a lack of regulation.

The remaining agenda of “Crypto Sprint” is expected to address unresolved challenges such as DeFi oversight, banking access, tax clarity, and inter-agency coordination.

SEC and CFTC Team Up: Regulatory Coordination Delivers Certainty

One of the greatest regulatory challenges in the US crypto market over the past few years has been the overlapping and ambiguous responsibilities between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Project teams have often faced simultaneous pressure from SEC compliance requirements and CFTC commodity trading rules, resulting in “regulatory limbo” and double enforcement—an inefficient and uncertain scenario that drains resources.

The “Crypto Sprint” marks the first time this issue is being directly addressed: the CFTC and SEC will work together to clarify the legal status of crypto assets (security or commodity), establish custody standards, and define trading compliance requirements. This will provide market participants with a unified, predictable compliance framework.

The “Crypto Sprint” represents not just an acceleration of regulatory pace but a shift to proactive collaboration. For Web3 teams, this is no longer a passive “wait-and-see” phase but an unprecedented opportunity to help shape the regulatory architecture. The CFTC is soliciting market feedback on its “listing spot crypto asset contracts on DCMs” proposal through August 18. Timely feedback not only helps participants avoid future regulatory pitfalls, but may also influence how new rules are crafted.

At the same time, the SEC’s “Crypto Project” is closely coordinating with the “Crypto Sprint,” aiming to establish a unified federal regulatory framework that clearly distinguishes between security and commodity crypto assets. It also seeks to enable the development of “super app” platforms, where multiple asset classes—including stocks, Bitcoin, stablecoins, and staking—can be lawfully traded under a single license.

Further Reading: “From SEC’s Project Crypto: What Does Trump Want to Trade?“

SEC Chair Paul Atkins and Commissioner Hester Peirce have publicly stated their support, calling this a “historic turning point for bringing financial systems on-chain.” They have also committed to expediting rulemaking in key areas including stablecoin regulation, crypto asset custody, and compliant token offerings.

This dual-track regulatory approach could finally resolve the confusion over whether crypto assets are securities or commodities in the US, setting a clear, replicable compliance benchmark for global markets.

Crucially, this shift means Web3 projects are no longer at risk of inadvertently violating unclear rules. Instead, through explicit registration, compliant custody, and audit procedures, they can integrate fully with mainstream finance and bridge the gap between on-chain assets and the real-world financial system.

Summary

In the past week, the US government has sent its clearest signal yet in the crypto asset sector: the White House released its “Digital Asset Strategy Report,” the SEC rolled out “Project Crypto,” and the CFTC entered a new phase of “Crypto Sprint”—making real-time federal-level digital asset trading a top priority and actively soliciting feedback to push for compliant spot contract listings. At the same time, the White House made the rare move of prohibiting banks from discriminating against crypto companies—signaling not just a shift in stance, but a significant policy change.

Not long ago, the SEC was the single biggest regulatory challenge for crypto projects. Now, we see it cooperating with the CFTC to build a unified compliance framework for Web3. The market is witnessing a historic transformation: from ambiguity to clarity, suppression to support, and regulatory gray zones to federal legislation.

This time, it’s not only the regulators sprinting forward, but every industry participant as well.

Disclaimer:

- This article is republished from BlockBeats. The original copyright is retained by kkk. If you have concerns regarding this republication, please contact the Gate Learn team, who will address them in accordance with established procedures.

- The opinions and views expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article have been translated by the Gate Learn team. Unless Gate is specifically cited, you may not reproduce, distribute, or plagiarize this translated content.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge